The upcoming repayments to thousands of victims from the 2014 Mt. Gox heist could affect Bitcoin prices, according to experts cited by CNBC. Bitcoin, the world’s largest cryptocurrency, fell below $60,000 last week, marking its second-worst weekly decline of the year.

On Monday, the bankrupt Tokyo-based Mt. Gox exchange announced that it would begin distributing the stolen assets in the first week of July. The exchange is expected to return more than 140,000 Bitcoin, worth almost $9 billion.

According to the court-appointed trustee overseeing the exchange’s bankruptcy proceedings, disbursements to the firm’s roughly 20,000 creditors will be a mix of Bitcoin and Bitcoin Cash. Trustees formulated a repayment plan and received a deadline of October 2024 from a Tokyo court last year.

Once the world’s top crypto exchange, handling over 70% of all Bitcoin transactions in its early years, Mt. Gox shut down and went bankrupt in February 2014 after suffering the biggest cryptocurrency heist on record. Hundreds of thousands of bitcoins were stolen from the exchange, which blamed hackers who exploited a software security flaw.

Analysts expect the upcoming Mt. Gox repayments to add selling pressure to Bitcoin markets. Early investors will receive the assets at a much higher price than when they initially bought in, making some inclined to profit from their holdings.

“Many will clearly cash out and enjoy the fact that having their assets stuck in the Mt. Gox bankruptcy was the best investment they ever made,”

said John Glover, chief investment officer of crypto lending firm Ledn.

“Some will clearly choose to take the money and run,”

he added.

However, some experts believe that there is sufficient market liquidity to cushion the blow of any potential mass selling. Analysts told CNBC that the losses are likely to be contained and short-lived.

“I think that sell-off concerns relating to Mt. Gox will likely be short term,”

said Lennix Lai, the chief commercial officer of crypto exchange OKX. He noted that

“many of Mt. Gox’s early users as well as creditors are long-term Bitcoin enthusiasts who are less likely to sell all of their Bitcoin immediately.”

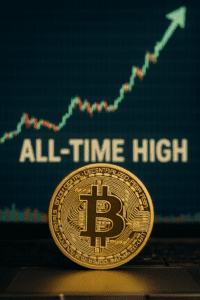

Earlier this year, Bitcoin experienced a major rally, climbing over $70,000 following the US Securities and Exchange Commission’s approval of the first spot Bitcoin ETF. The latest Bitcoin halving in April – a mechanism to limit supply that occurs every four years – also propelled the cryptocurrency’s price.

As of Tuesday, Bitcoin was trading down almost 2% at $61,849 per token or R1,151,853 rand.