In the current economic climate, characterized by a depreciating dollar-to-rand exchange rate hovering around 18.5:1, high interest rates at 11%, and inflation at 6.9%, investing in South African real estate may not yield the returns investors anticipate.

Depreciating Currency and Its Impact

The depreciation of the rand against the dollar significantly impacts the purchasing power of international investors. A weaker rand means that any returns on investment, when converted back to a stronger currency like the dollar, will be diminished. For example, if you invest 2 million rand and the rand depreciates further, the dollar value of your returns will decrease, eroding the real return on investment.

High Interest Rates

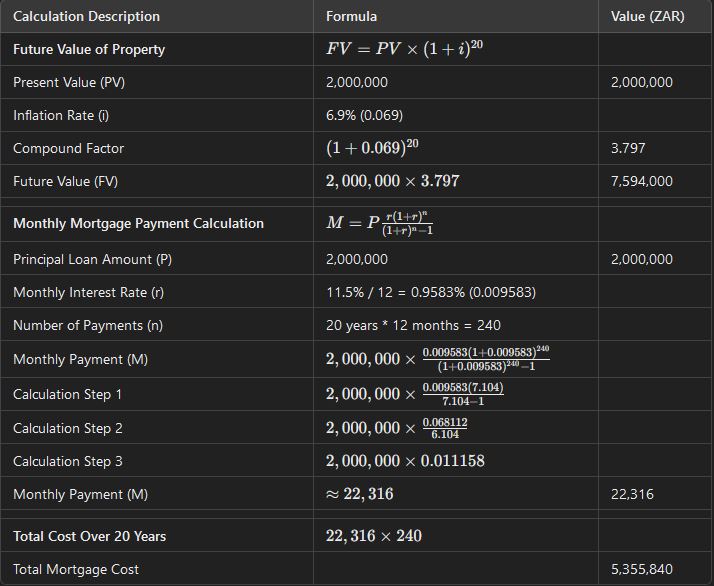

Interest rates are currently at 11%, which directly affects mortgage costs. High interest rates increase the cost of borrowing, thereby reducing the overall profitability of property investments. Here’s a technical breakdown:

- Higher Monthly Payments: With an 11% interest rate, monthly mortgage payments are significantly higher compared to lower interest rate environments. This increased financial burden reduces the net rental yield, which is the rental income minus expenses and interest costs.

- Opportunity Cost: High interest rates also mean that alternative investments might offer better returns. For instance, fixed-income securities and high-yield savings accounts become more attractive, as they offer competitive returns with lower risk compared to property investment.

Inflationary Pressures

Inflation at 6.9% erodes the real value of rental income and property value over time. While nominal prices may increase, the real purchasing power of those returns diminishes. This can be broken down as follows:

- Reduced Real Returns: Inflation reduces the real returns on rental income. If rental income increases by 5% annually but inflation is at 6.9%, the real return is actually negative.

- Maintenance and Upkeep Costs: Inflation also increases the cost of property maintenance and repairs. Higher costs reduce the net income from the property, further diminishing the yield.

Future Value of Property

To understand if the property appreciates enough to cover the mortgage cost, we need to calculate the future value of the 2 million rand house over 20 years, considering the inflation rate of 6.9%.

Analysis

The total repayment amount of 5,355,840 ZAR includes a significant amount of interest paid over the 20 years. Given the depreciating rand, high interest rates, and inflation, the net returns on this investment are likely to be lower than expected.

- Interest Paid: The interest component is a substantial 3,355,840 ZAR (5,355,840 – 2,000,000), indicating that the cost of borrowing is exceedingly high.

- Real Returns: When adjusted for inflation, the purchasing power of the rental income and property value appreciation is considerably diminished.

- Future Value of Property: The future value of the property, adjusted for 6.9% inflation, would be approximately R7,594,000. While this seems to cover the total mortgage cost, it must be noted that this is a nominal figure and does not account for potential market fluctuations, maintenance costs, and other associated expenses.

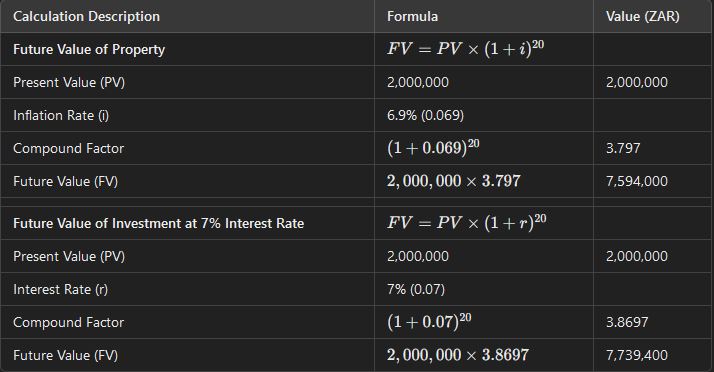

What about the future value of 2 million rand collecting interest at a rate of 7% per annum over 20 years?

Comparison with Savings at 7% Interest

To further illustrate the investment dynamics, let’s compare the future value of a 2 million rand investment in property with an equivalent amount placed in an interest-bearing account at 7% per annum for 20 years.

Future Value Calculation

Using the compound interest formula:

FV = PV×(1+r)n

FV = PV x (1 + r)^n

FV = PV×(1+r)n

Where:

- PV = 2,000,000

- r = 0.07

- n = 20

FV = 2,000,000 × (1+0.07)20

FV = 2,000,000 × 3.8697

FV = 2,000,000×3.8697

FV ≈ R 7,739,400

Analysis and Conclusion

When comparing the future value of 2 million rand invested in property versus the same amount invested at a 7% interest rate over 20 years, the results are striking:

- Property Investment: Assuming the property value increases in line with the inflation rate of 6.9%, the future value of the property would be approximately R 7,594,000.

- Interest-Bearing Account: The same amount invested at a 7% annual interest rate would grow to approximately R 7,739,400.

While the property investment seems to cover the mortgage costs nominally, the interest-bearing account provides a slightly higher future value without the risks and additional costs associated with property investment, such as maintenance, potential market fluctuations, property taxes, issues with retrieving rent. Given the high interest rates and inflation, alternative investments might offer better returns with lower risk.

Investors should carefully consider these factors and diversify their portfolios to mitigate risks and optimize returns.

Lower interest rates and controlled inflation are essential to creating a favorable financial atmosphere for property investment. Ideally, interest rates should be below 6%, and inflation should be kept around 2-3%. These conditions provide a balance between affordable borrowing costs and stable real returns, enhancing the profitability of property investments over the long term. Investors should monitor these economic indicators closely and adjust their investment strategies accordingly to maximize returns.