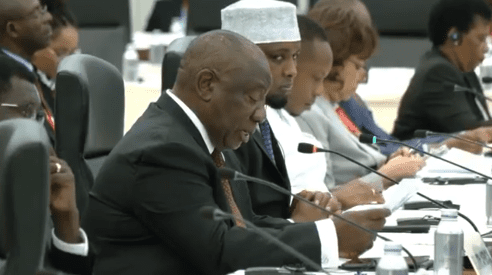

On the margins of the 9th Tokyo International Conference on African Development Summit (TICAD9) held in Yokohama, South African President Cyril Ramaphosa has intensified economic diplomacy with Japan, meeting several influential business leaders and corporations in key sectors such as automotive manufacturing and renewable energy.

This strategic initiative by Ramaphosa comes amid growing global economic pressure, most notably the recent 30 percent tariff hike imposed on South African exports entering the United States market. While the decision from Washington posed fresh challenges, it also created opportunities for recalibration—prompting Ramaphosa to seek out deeper, diversified trade partnerships. Japan, a long-time economic partner, emerged as a logical and timely choice.

“We are seeing the President at work as a businessman because we are no longer forced to sustain ties with one region.”

President Ramaphosa’s efforts signal more than mere diplomacy—they reflect a calculated pivot in economic policy. His engagements during TICAD9 included meetings with several Japanese firms, notably in the auto manufacturing and clean energy fields, sectors vital to South Africa’s industrial base and future green economy ambitions.

One of the standout interactions was with Mitsui & Co., a major stakeholder holding 27.5 percent in Mainstream Renewable Power. The company currently manages a formidable 12 gigawatt pipeline of wind and solar projects in South Africa, including a 97.5 megawatt solar facility developed for Sasol and Air Liquide that recently reached financial close. Mitsui, classified among Japan’s elite “sōgō shōsha” or general trading houses, has been shifting its focus more aggressively toward next-generation fuels and decarbonisation technologies—areas aligned with South Africa’s sustainability goals.

Further anchoring South Africa’s industrial partnership with Japan, Ramaphosa also met with Shinsuke Minami, President and Chief Operating Officer of Isuzu Motor Corporation. Isuzu’s manufacturing base in Gqeberha, Eastern Cape, underwent a R1.2 billion investment to modernise its plant, introducing a new body shop, upgraded paint facilities, and a revised chassis line. The site now produces the 7th-generation D-MAX and serves as a strategic export hub for Sub-Saharan Africa, delivering vehicles to 34 countries in the region and assembling knockdown kits in Kenya.

“I trust the President’s judgement and overall strategy to get South Africa back to being profitable, particularly in the auto sector. The increased investment of Japanese automakers would help small businesses,”

remarked entrepreneur Sibusiso Ngwenya, who is currently spearheading an initiative to develop South Africa’s first electric vehicle. He sees Ramaphosa’s outreach as a shrewd response to recent geopolitical shifts.

“It is bold and decisive of South Africa to heighten ties with Japan car makers.”

Japan’s automotive presence in South Africa is both deep and diverse. From Toyota and Mazda to Isuzu and Nissan, Japanese brands dominate significant portions of the domestic vehicle market. According to Ngwenya, even European manufacturers often rely on components sourced from Japanese suppliers—a fact that reinforces the strategic value of these partnerships.

Ramaphosa’s agenda in Japan also included discussions with Seiji Izumisawa, Chairperson of Mitsubishi Heavy Industries, as well as Norihiko Ishiguri, Chief Executive Officer of the Japan External Trade Organisation (JETRO). These talks form part of a broader effort to strengthen both private sector collaboration and state-level ties, supported by a high-ranking South African business delegation.

The Presidency confirmed that Ramaphosa is leveraging South Africa’s current presidency of the G20 to deepen economic relationships not only through summits but also through targeted bilateral meetings. The emphasis, officials said, remains on attracting investment, enhancing industrial capabilities, and securing market access in a changing global trade environment.

While the spotlight has remained on renewable energy and automotive manufacturing, the relationship between South Africa and Japan spans a broader spectrum. In 2024, trade between the two nations totalled R132 billion, with South Africa achieving a R52 billion surplus. This was primarily driven by platinum exports, although agriculture is fast becoming another significant growth area. Avocados and nuts, in particular, are among the rising exports gaining attention in the Japanese market.

“The increased investment of Japanese automakers would help small businesses.”

The longevity of relations between the two nations—stretching back over 115 years—has fostered collaboration not just in trade, but in science, innovation, and inclusive economic development. South Africa and Japan continue to align on research initiatives and technology exchanges, reflecting a mutual interest in balancing industrial growth with sustainability.

What many observers are now asking is whether Ramaphosa’s proactive diplomatic stance will help South Africa transition from vulnerability in the global market to opportunity through new alliances. The answer may lie not only in the volume of investment but in its character—targeted, job-creating, and forward-looking.