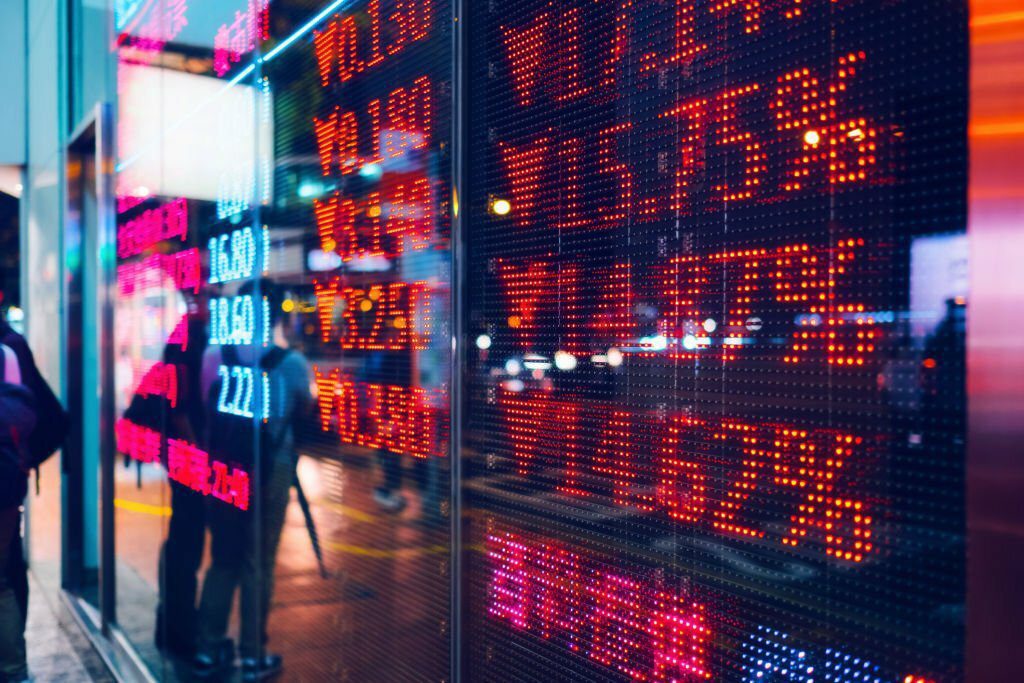

In a striking disclosure that has cast a shadow over South Africa’s financial industry, recent findings have brought to light the extensive and covert manipulation of the South African rand.

This revelation, involving Standard Chartered Bank and several other major banking institutions, has unveiled a complex web of unethical financial practices, raising serious questions about the integrity and oversight of currency trading in the country.

As the details of this manipulation unfold, the impact resonates not just within the financial markets, but also among the general public, policymakers, and regulatory bodies, signaling a pivotal moment in South Africa’s economic landscape.

Currency Trading Under Scrutiny

In a recent development that has sent ripples through the financial sector, Makgale Mohlala, the Competition Commission’s divisional manager for cartels, revealed to the Competition Tribunal that an average of R1 trillion was traded daily in the currency market between 2007 and 2013. This revelation came during a period of heightened scrutiny of currency trading practices.

Standard Chartered Bank’s Admission

Mohlala, in a statement to the SABC, discussed the recent admission by Standard Chartered Bank (SCB) of its involvement in manipulating the South African rand. This admission places SCB among 17 other banks implicated in similar unethical practices. Earlier this week, SCB acknowledged its wrongdoing and consented to a R42 million settlement with the Competition Commission for its part in a scheme to rig trades involving the US dollar-rand currency pair.

Impact on the Trading Market

“There are buyers and sellers. South African firms that want to buy internationally, they’ll need to acquire the dollars in order for them to buy in the international market,” Mohlala explained. He further added, “If they buy in dollars that are expensive, because of the manipulation, they are losing money. South Africans that want to sell in the international market, have to sell using dollars, so if they have to sell using a dollar that has been weakened by manipulations, they are losing money.”

EFF Calls for Stricter Sanctions

The Economic Freedom Fighters (EFF) have voiced their concerns over this issue, as reported by The Star. The party has called for more stringent measures against banks involved in the manipulation of the rand. Criticizing the South African Reserve Bank for its alleged failure to effectively oversee the banking sector, EFF national spokesperson Sinawo Thambo highlighted the broader issues within the banking industry.

“The failure to deal with currency manipulation, however, is just a symptom of a banking sector that is a law unto itself,” Thambo stated. He also accused the Reserve Bank of “friendship-based nepotism” and a revolving door policy between banks, the National Treasury, and the Reserve Bank itself.

Commission’s Response to the Settlement

The Competition Commission has welcomed the settlement with Standard Chartered, viewing it as a significant step in addressing currency manipulation. The bank’s admission of liability and agreement to pay a R42.7 million penalty is seen as a victory for South Africa, according to Commission spokesperson Siyabulela Makunga.

Public Reaction and Analysis

As the situation unfolds, the implications of Standard Chartered Bank’s admission and the broader issue of currency manipulation in the South African financial market continue to be a topic of significant public and regulatory interest.