South Africa’s electricity landscape is set for significant transformation as the Electricity Regulation Amendment Bill, signed into law by President Cyril Ramaphosa, introduces sweeping reforms aimed at restructuring the country’s electricity sector.

These changes are expected to foster increased competition, drive down energy costs, and attract investment in new generation capacity to enhance energy security. The bill also mandates the creation of an independent transmission company, which will oversee the national grid, while imposing severe penalties for damage to or sabotage of critical infrastructure.

The newly enacted legislation aims to update the Electricity Regulation Act of 2006, creating opportunities for greater competition in the energy market and incentivizing investment in generation capacity. The primary objective is to ensure the security of the nation’s energy supply, an issue that has plagued South Africa for years. The establishment of a competitive electricity market lies at the heart of these reforms.

Central to this reformed structure is the creation of a Transmission System Operator SOC Ltd (TSO), which must be established as an independent entity within the next five years. Until this new entity is formed, the National Transmission Company of South Africa will serve as the TSO, ensuring that the transition is smooth. In addition, the act introduces an open market platform, facilitating the competitive buying and selling of electricity, whether at a wholesale or retail level.

In a statement, the Presidency highlighted the significance of these changes:

“The act provides for market operation as a new activity that may be licensed by the National Energy Regulator of South Africa (Nersa). In addition, it requires the development of a Market Code that will establish rules to govern the future competitive market, and outlines the process through which the code will be approved. The act further clarifies the principles that apply to the setting or approval of prices, charges and tariffs.”

Beyond the market reforms, the new law takes a firm stance against acts of vandalism or sabotage targeting electricity infrastructure. Individuals found guilty of damaging, removing, or destroying transmission, distribution, or reticulation cables, equipment, or related infrastructure now face stiff penalties. Those convicted could be fined up to R1 million, sentenced to five years in prison, or both. Furthermore, the law extends penalties to those receiving such stolen infrastructure, with fines reaching as high as R5 million or a prison sentence of up to 10 years, or both.

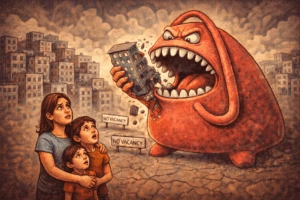

As the government rapidly moves towards creating a competitive energy market, concerns have emerged among experts regarding the potential challenges. Private independent power producers (IPPs) are expected to quickly secure what limited grid space remains, intensifying competition. This follows a decision by Nersa to reject Eskom’s application for grid capacity reservation, a measure intended to safeguard public procurement programmes and improve their chances of success.

The Alternative Information and Development Centre (AIDC) has voiced concerns about the possibility of market concentration, particularly as larger companies could dominate the competitive landscape. The AIDC also raised questions about Eskom’s long-term viability in a more competitive environment, where declining demand and escalating costs could undermine the state-owned utility’s financial health.

Energy analyst Hugo Kruger weighed in on the ongoing debate, casting doubt on whether liberalized markets will indeed result in lower electricity prices. Kruger pointed out that some regulated markets in the United States manage to maintain lower energy costs. He expressed concern that Eskom could face serious financial difficulties in an open market:

“Several US states with regulated markets have lower costs. If Eskom has to truly compete in a true market, then theoretically it risks bankruptcy. It means that the IPPs can also go bankrupt,”

Kruger said.

Kruger also questioned the government’s approach to managing the Integrated Resource Plan (IRP), noting the challenges of balancing competition and energy security. According to Kruger, the government’s strategy appears to involve dividing market share among different energy generators, but he remains sceptical about the long-term outcomes of this approach.

“In a true market, you have competition. If solar is cheaper 100% of the time, then you only end up with solar. The government’s thinking with the IRP is that they can slice up what percentage every generator gets. Then call that a market. In terms of energy security, they are somewhat correct, competition theoretically should attract investment, but it remains to be seen how the market will work in practice. There are a lot of ‘what ifs’ and hypotheticals at the moment,”

Kruger concluded.

While the reforms hold promise for a more efficient and competitive electricity market, their successful implementation will depend on careful regulation and ongoing investment. For now, South Africa enters a period of uncertainty as it navigates the complexities of a liberalized energy sector and the accompanying challenges of maintaining a stable and affordable power supply.